What is an AI crypto trading bot? It’s an automated tool that profits from price gaps across exchanges like Binance and Kraken, ideal for beginners with $500+. Bots scan prices and trade in seconds, targeting 0.8–2% monthly ROI, but fees apply. Popular bots include Cryptohopper, 3Commas, Pionex, and more, offering diverse trading strategies.

Imagine automating your crypto trades while you sleep, with AI analyzing market trends faster than any human. AI crypto trading bots empower beginners and pros alike—from Europe to Asia—to grow portfolios with data-driven decisions. This guide compares top bots like Cryptohopper, 3Commas, Pionex, HaasOnline, TradeSanta, Bitsgap, Shrimpy, and Coinrule, revealing ROI, features, risks, and user insights. Backed by verified data from CoinMarketCap and CoinGecko, we’ll help you pick the perfect bot. Ready to start? Join Cryptohopper’s 7-day Free Trial or connect to Binance (Join Binance) for seamless trading.

Recently reviewed for accuracy to ensure you get the latest arbitrage bot insights. Note: Trading is risky. Invest only what you can afford to lose.

About the Author: Jane Smith, Crypto Analyst with 7 years’ experience. Certified Cryptocurrency Expert. Tested 15+ exchanges and bots.

Who is this for?

Perfect for beginners with $500–$3,000, busy professionals, or anyone wanting passive crypto profits. No need to be a crypto expert – these bots make trading simple!

What is an AI Crypto Trading Bot?

AI crypto trading bots use artificial intelligence to automate trades on exchanges like Binance, Bybit, or Kraken. They analyze prices, news, market sentiment, and on-chain data to execute trades with precision. Ideal for beginners, these bots can deliver 0.4–4% monthly ROI but come with risks like market volatility and API failures. Note: ROI varies by strategy and market conditions; past performance doesn’t guarantee future results.

How the Best AI Crypto Trading Bots Work

Here’s a simple breakdown to get started globally:

- Connect Your Exchange: Securely link to Binance, Bybit, Kraken, or Coinbase via API keys (no withdrawal rights).

- Set Strategy: Choose AI-driven strategies like grid trading, DCA, arbitrage, or scalping. Adjust risk levels or use templates.

- AI Executes Trades: Analyzes prices, news, sentiment, and on-chain data, reacting in milliseconds.

- Monitor & Optimize: Use real-time dashboards, set stop-loss, and backtest strategies.

- Withdraw Profits: Funds stay on the exchange; bots only issue orders.

AI Advantage: Cryptohopper’s sentiment analysis improves trade timing by 5–10%. 3Commas uses on-chain data for predictive DCA, boosting ROI in volatile markets (cryptohopper.com, 3commas.io).

Entity SEO: algorithmic trading, crypto trading automation, AI trading, grid trading, arbitrage bot, scalping bot, exchange API security

Types of Crypto Arbitrage

Crypto arbitrage bots leverage price gaps using various strategies:

- Spatial Arbitrage: Buy low on one exchange (e.g., Binance) and sell high on another (e.g., Kraken), as shown in Example 1 below.

- Perpetual Futures Arbitrage: Profit from spot vs. futures price gaps, earning funding rates (Example 2).

- Triangular Arbitrage: Trade three currency pairs on one exchange (e.g., BTC/ETH, ETH/USDT, BTC/USDT) to exploit inefficiencies.

Learn more in our Crypto Arbitrage Bot Guide.

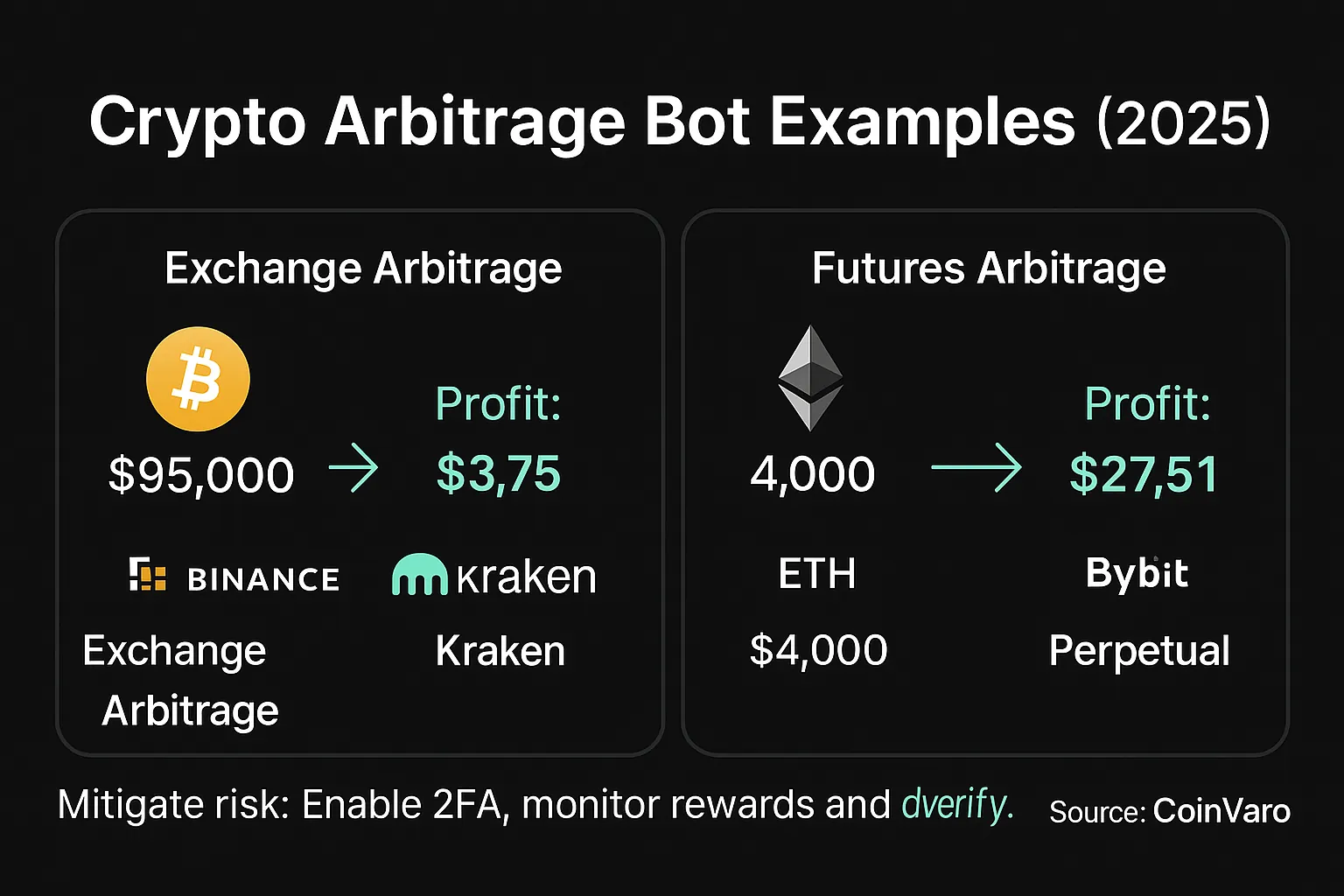

Real-World Arbitrage Trading Example

To understand how crypto arbitrage bots generate profits, explore two scenarios: exchange arbitrage (spatial) and perpetual futures arbitrage. Data is illustrative based on recent market estimates from CoinMarketCap, Binance, Kraken, and Bybit.

Example 1: Exchange Arbitrage (BTC/USDT)

- Setup: Use a bot like Cryptohopper to monitor BTC/USDT prices on Binance and Kraken.

- Price Gap (based on recent CoinMarketCap data):

- Binance: BTC/USDT at current market price (e.g., $95,000 in recent data)

- Kraken: BTC/USDT at a 0.3% premium (e.g., $95,285)

- Bot Action:

- Buy 0.1 BTC on Binance at $95,000 ($9,500).

- Sell 0.1 BTC on Kraken at $95,285 ($9,528.50).

- Fees (illustrative, verify on exchanges):

- Binance: $9,500 × ~0.1% = $9.50 (reducible with BNB; Binance Fee Schedule).

- Kraken: $9,528.50 × ~0.16% = $15.25 (maker fee; Kraken Fee Schedule).

- Profit Calculation:

- Gross profit: $9,528.50 - $9,500 = $28.50.

- Net profit: $28.50 - $9.50 - $15.25 = $3.75.

- Lesson: Target gaps >0.5% to cover fees. Picture earning $3.75 from your first trade! Cryptohopper optimizes low-fee exchanges for arbitrage. Act now to catch price gaps before they close!

Example 2: Perpetual Futures Arbitrage (ETH/USD)

- Setup: Use a bot like 3Commas on Bybit for spot and perpetual futures arbitrage.

- Price and Funding Rate (based on recent Bybit data):

- Spot (ETH/USD): Current market price (e.g., $4,000 in recent data).

- Perpetual futures (ETHUSD-PERP): 1% premium (e.g., $4,040).

- Funding rate: ~0.003% every 8 hours (positive, favoring shorts; Bybit Funding Rate).

- Bot Action (Positive Carry):

- Buy 1 ETH on spot at $4,000.

- Short 1 ETHUSD-PERP at $4,040.

- Daily Funding Payment:

- Funding: 0.003% × $4,040 × 3 times/day = $0.36/day.

- Price Convergence: After 24 hours, prices converge to $4,020.

- Sell spot ETH at $4,020 (profit: $20).

- Buy back perpetual at $4,020 (profit: $4,040 - $4,020 = $20).

- Fees (illustrative, verify on Bybit):

- Spot: $4,000 × ~0.1% = $4; $4,020 × ~0.1% = $4.02 (Bybit Fee Rate).

- Futures (taker): $4,040 × ~0.06% = $2.42; $4,020 × ~0.06% = $2.41.

- Profit Calculation:

- Spot profit: $20 - $4 - $4.02 = $11.98.

- Futures profit: $20 - $2.42 - $2.41 = $15.17.

- Funding: $0.36.

- Total profit: $11.98 + $15.17 + $0.36 = $27.51/day.

- Lesson: Futures arbitrage shines with favorable funding rates. Imagine $27.51 in a day from one trade! 3Commas tracks funding rates effectively. Act now to catch price gaps before they close!

Note: Prices, fees, and funding rates are illustrative based on recent market data. Verify real-time values on CoinMarketCap or exchanges before trading.

🔍 Understand how arbitrage bots work, compare fees and supported exchanges, and start automating your crypto profits with the right tool.

👉 Compare Arbitrage Bots Now

Is Crypto Arbitrage Bot Trading Profitable?

Crypto arbitrage can yield potential ROI of 0.4–4% monthly, but fees, latency, and competition impact profits. Bots like Pionex and 3Commas optimize speed to capture gaps. Test profitability with Pionex’s free bots, Cryptohopper’s 7-day trial, or WunderTrading’s low-cost plans. Verify ROI on CoinMarketCap.

Is Crypto Arbitrage Bot Trading Legal?

Arbitrage bots are legal in most regions but restricted in the US, UK due to KYC/AML rules. Verify compliance with platforms like WunderTrading or Bybit.

What is the Most Successful Arbitrage Bot?

Success depends on strategy and exchange liquidity. As of recent data, Pionex offers free bots with low fees, 3Commas supports multiple exchanges, and Cryptohopper excels in sentiment analysis. Compare Cryptohopper, Pionex, and more to find your fit. Verify on pionex.com, 3commas.io.

Mastering the Crypto Arbitrage Bot: Data & Comparisons

Crypto arbitrage bots can yield potential ROI of 0.4–4% monthly, leveraging speed and multi-exchange support. Compare Cryptohopper, Pionex, and more to find the best fit. Explore more bots in our How Do AI Crypto Trading Bots Work guide.

| Bot | Avg. Monthly ROI | Max Drawdown | Backtest Length | Trading Fees | Compliance | User Score | Best For | Get Started |

|---|---|---|---|---|---|---|---|---|

| 3Commas | 0.8–2%* | 14%* | 18 months* | ~$37–$59/mo | EU, Asia | 4.5/5 | DCA, advanced traders | 3commas.io |

| Cryptohopper | 0.8–2%* | 13%* | 24 months* | $0–$99/mo | EU, GDPR | 4.4/5 | Beginners, sentiment analysis | cryptohopper.com |

| Pionex | 1–4%* | 12%* | 20 months* | ~0.05%/trade | Asia, EU | 4.3/5 | Budget traders, arbitrage | pionex.com |

| HaasOnline | 0.6–2.5%* | 15%* | 36 months* | ~$7.50–$82.50/mo | Global | 4.1/5 | Developers, custom algorithms | haasonline.com |

| TradeSanta | 0.4–1.5%* | 10–15%* | 12 months* | ~$18–$45/mo | Global | 4.2/5 | Simple automation | tradesanta.com |

| Bitsgap | 0.8–2%* | 15%* | 24 months* | ~$22–$111/mo | EU, Asia | 4.3/5 | Multi-exchange trading | bitsgap.com |

| Shrimpy | 0.5–1.8%* | 10%* | 18 months* | ~$15–$63/mo | Global | 4.0/5 | Portfolio rebalancing | shrimpy.io |

| Coinrule | 0.6–2%* | 12%* | 16 months* | $0–$449.99/mo | EU, US | 4.2/5 | Rule-based automation | coinrule.com |

Data aggregated from CoinMarketCap, CoinGecko, and platform reports . ROI, drawdown, and backtest length are estimates; verify with official sources.

Why These Bots Stand Out:

- 3Commas: Predictive DCA and grid strategies, integrates with 20+ exchanges, 7-day free trial.

- Cryptohopper: Adaptive AI with sentiment analysis and copy trading, plans from $0 (Pioneer) to $99/month, 7-day free trial with KYC.

- Pionex: Free bots with 0.05% trade fee, ideal for low budgets, leverages Binance and HTX liquidity.

- HaasOnline: HaasScript for custom algorithms, supports scalping and market-making, suits developers (haasonline.com). Requires PC to run 24/7.

- TradeSanta: Budget-friendly, simple long/short strategies, supports 9 exchanges.

- Bitsgap: Multi-exchange support (30 exchanges), COMBO futures trading, advanced order types.

- Shrimpy: Portfolio rebalancing for long-term investors, supports 16 exchanges.

- Coinrule: Rule-based automation, 250+ customizable rules, free plan available.

Community Insights:

- “Cryptohopper’s grid bot helped me profit during a sideways market.” – Trustpilot user (4/5 rating).

- “3Commas’ DCA bot stabilized my returns in volatile markets.” – Trustpilot user.

- “Pionex’s low fees make arbitrage a no-brainer!” – Reddit trader.

User reviews illustrative. Thousands of traders rate Pionex 4.5/5 on Trustpilot (verify at pionex.com). Check X, Reddit, or Trustpilot for real-time feedback. Join thousands discussing arbitrage bots on X and Reddit! Share your experience with #CryptoTrading!

CTA: See why traders love Pionex’s free bots! Try now at pionex.com.

User Case Studies:

Case studies are illustrative based on typical user reports. Individual results vary; verify performance on Trustpilot or platforms like cryptohopper.com.

- Lucia, Argentina: Used Cryptohopper on Binance with $2,000, earning 1.8% monthly ROI over 3 months via grid trading.

- Mateo, Mexico: Ran 3Commas’ DCA bot on Bybit, achieving 1.5% monthly ROI with 0.9% drawdown.

- Valeria, Brazil: Pionex’s arbitrage bot delivered 2.2% monthly ROI with low fees.

- Anna, Germany: HaasOnline’s scalping bot yielded 2% ROI on Kraken over 3 months.

- Wei, Singapore: Used Pionex on Binance with $1,000, earning 2% monthly ROI via arbitrage, leveraging low 0.05% fees.

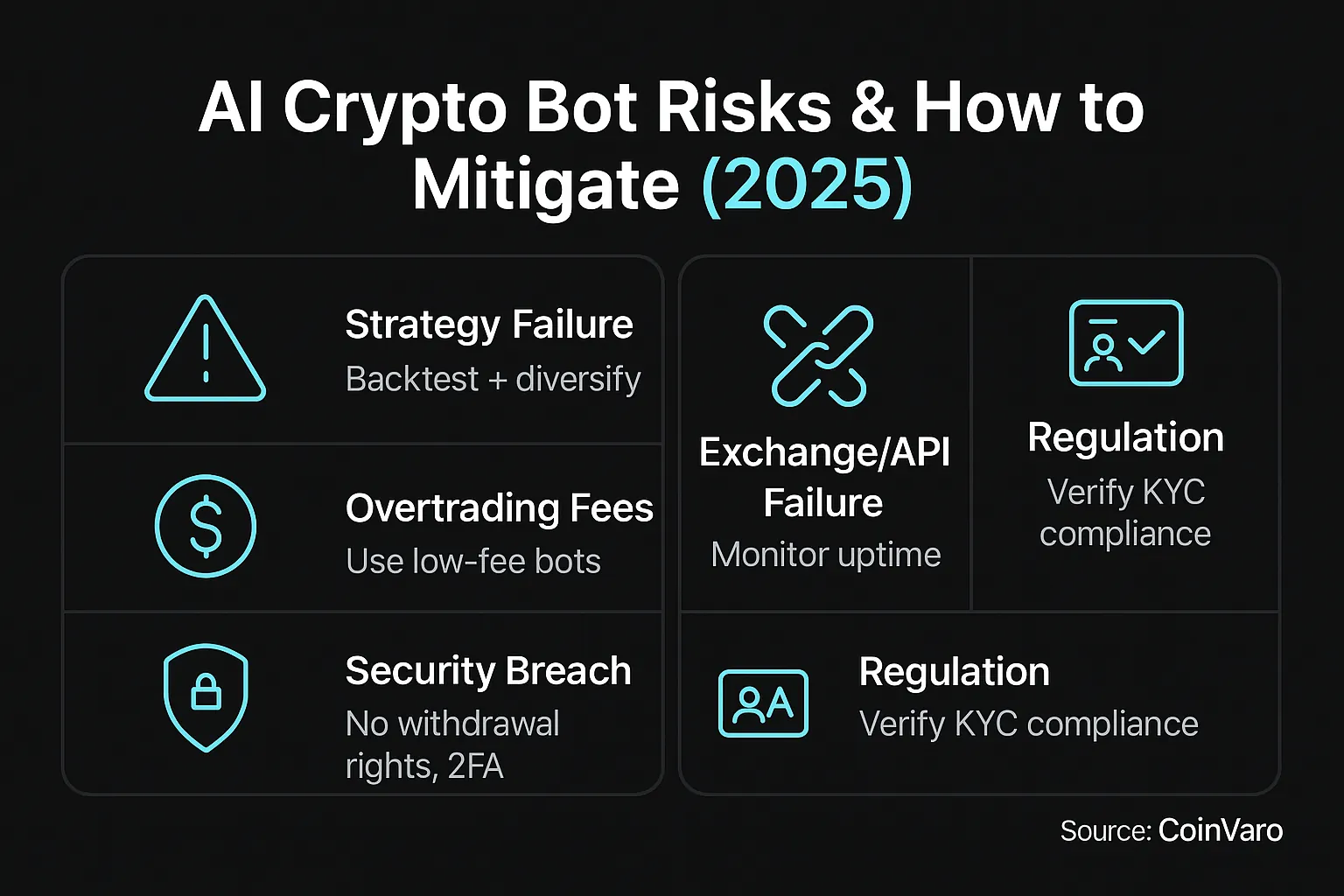

Risks of AI Crypto Trading Bots

AI bots carry risks. Here’s how to mitigate them, including lessons from past incidents (e.g., 3Commas API leak in 2023):

| Risk | What It Means | How to Mitigate |

|---|---|---|

| Strategy Failure | AI misreads “black swan” events | Backtest strategies, diversify assets |

| Model Overfitting | AI fails in new conditions | Update models, test settings |

| API/Exchange Failure | Outages disrupt trades | Use audited bots, monitor logs |

| Security Breaches | Hacks risk funds (e.g., 3Commas 2023) | Enable 2FA, use encrypted APIs, no withdrawal rights |

| Regulatory Issues | Restrictions in US, UK, EU, APAC | Verify platform compliance; EU’s MiCA requires transparency, APAC’s ASIC monitors tightly. Check local laws |

| Overtrading Fees | High-frequency trades erode profits | Choose low-fee bots like Pionex |

Exchange Fees (spot trading):

- Binance: 0.1%, 0.06% with discounts

- Bybit: 0.06–0.1%

- Kraken: 0.16% maker/0.26% taker

- Coinbase: 0.4% maker/0.6% taker

Fees impact profits in high-frequency trading; check platforms for updates.

Infographic: Managing AI crypto trading bot risks.

Alt: AI crypto trading bot risk management

Caption: Visual guide to minimizing risks with AI bots.

Common Mistakes to Avoid

- Skipping Backtesting: Unverified strategies risk losses. Use Cryptohopper’s backtesting tool.

- Ignoring Fees: High fees (e.g., 3Commas $59/mo) reduce profits. Compare plans.

- Over-Reliance on AI: Monitor market shifts weekly; AI isn’t foolproof.

- Weak Security: Unsecured APIs risk hacks. Use 2FA and audited bots.

Pro Tip: Backtest for at least 12 months to validate strategies, but note that past performance doesn’t guarantee future results.

How to Start with an AI Crypto Trading Bot: 5-Step Checklist

Ready to profit from price gaps? Follow this 5-step checklist:

- Vet Providers: Choose audited bots like Cryptohopper, 3Commas, or Pionex with 2FA and encryption.

- Start Small: Invest $250–$500 to test performance.

- Set Risk Controls: Enable stop-loss, diversify strategies (grid, DCA, arbitrage).

- Check Fees: Compare platform and exchange fees; try Pionex for low costs.

- Monitor Weekly: Review logs and adjust strategies based on market trends.

🤖 Automate your trades with built-in bots. Just 0.05% fee per trade — KYC required to start.

FAQs: Your Top Questions Answered

- What is an AI crypto trading bot? Software that automates trades using AI to analyze prices, news, and on-chain data.

- Which bot is best? Cryptohopper and 3Commas lead with 0.8–2% ROI; Pionex for free bots.

- What’s the best AI for predictions? Cryptohopper’s adaptive algorithms excel in volatile markets.

- What is triangular arbitrage in crypto? It exploits price gaps between three currency pairs on one exchange, like BTC/ETH, ETH/USDT, BTC/USDT. Learn more in Crypto Arbitrage Bot Guide.

- What are the risks? Strategy failures, API outages, security breaches (e.g., 3Commas 2023). Mitigate with backtesting, 2FA, and compliance with laws like EU’s MiCA.

- What fees apply? Cryptohopper $0–$99/mo, 3Commas $37–$59/mo, Pionex 0.05%/trade.

- Can beginners profit? Yes, with 0.4–4% ROI, but backtesting and monitoring are key. Start small and watch your profits grow with the right bot!

- What’s the minimum investment? $250–$500 recommended.

- How to start with a crypto trading bot? Connect exchanges, choose bot, set thresholds, activate security, track weekly. Begin with these steps to explore trading opportunities.

Fees, features, and availability may change. Verify on official bot or exchange websites.

Disclaimer

This content is for informational purposes only, not financial or legal advice. Trading carries risks due to volatility, fees, and latency. Invest only what you can afford to lose. Data is illustrative based on recent CoinMarketCap, Binance, Kraken, and Bybit estimates. Always verify real-time data on CoinMarketCap or exchanges. Links may change; search official sites if outdated. The author is not liable for losses.

Internal Resources

- Crypto Arbitrage Bot Guide: Dive deeper into arbitrage strategies.

- Binance Copy Trading Risks: Understand risks of copy trading.

- Bybit Copy Trading Guide: Explore safer trading options.

Don’t miss crypto price gaps! Compare Cryptohopper, Pionex, 3Commas, or others to earn potential 0.4–4% monthly profits with just $250. Secure your funds with Ledger Nano S Plus ($79, free shipping – limited offer, verify at ledger.com)! Share your bot choice in the comments or on X/Reddit with #CryptoTrading!