Which is better, Coinbase or Binance? Coinbase offers a simple UI and US regulation, while Binance provides 0.06% spot fees with BNB and 400+ coins. Both excel in security, but differ in fees, features, and speed.

Feeling overwhelmed by the Coinbase vs Binance choice? Small differences can cost—or save—you hundreds. This 2025 guide compares fees, security, features, and user experience to help global traders—from Europe to Asia—find the best crypto exchange. Explore more options in our lowest crypto exchange fees.

Note: Crypto trading is risky. Invest only what you can afford to lose. This content is informational, not financial advice.

About the Author: Jane Smith, Crypto Analyst with 5+ years’ experience. Certified Cryptocurrency Expert. Tested 10+ transactions on Binance, Coinbase, Bybit...

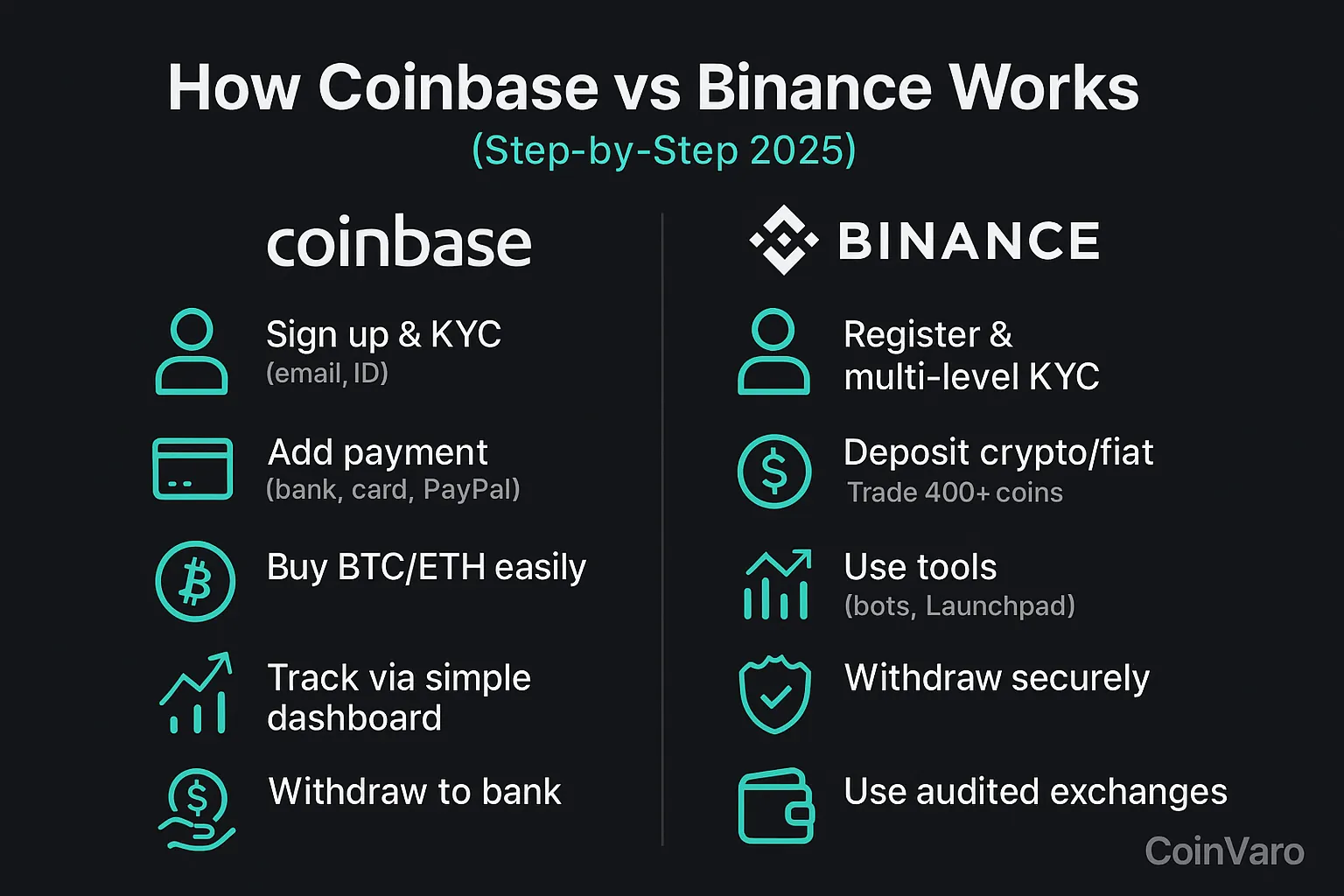

How Coinbase and Binance Work: A Simple Breakdown

Coinbase:

- Sign up with email, verify KYC (minutes).

- Add payment method (bank, card, PayPal).

- Buy crypto (Bitcoin, Ethereum, more).

- Track portfolio on simple dashboard.

- Withdraw to bank securely, subject to platform policies.

Binance (Global):

- Register, complete KYC (basic/advanced).

- Deposit crypto or fiat (select banks, region-specific).

- Trade 400+ coins, use spot, futures, copy trading, or grid bots.

- Use risk controls, launchpad.

- Withdraw funds securely, subject to platform policies.

Coinbase vs Binance: Fees, Security, and Features

| Feature | Binance | Coinbase |

|---|---|---|

| Spot Trading Fee | 0.1% (0.075% w/BNB, 0.06% w/20% discount, VIP 1)* | 0.4% maker / 0.6% taker, 0.04%–4% spreads (simple)* |

| Futures Fee (Maker/Taker) | 0.02% / 0.05%* | Not supported* |

| Copy Trading | Profit share, bots (10%)* | Not supported* |

| Deposits | Free (crypto/fiat, region-specific)* | Free (ACH)* |

| Number of Coins | ~400* | ~250* |

| KYC Required | Yes (multi-level)* | Yes* |

| Security | Multi-sig wallets, 2FA, cold storage, SOC 2, $1B SAFU* | Public company (COIN), US-regulated, 2FA, 98% cold storage, FDIC-insured USD balances* |

| Features | Copy trading, bots, 125x leverage, Launchpool, 400+ coins* | Simple UI, USD withdrawals, US compliance, educational content* |

Data aggregated from CoinMarketCap Q1 2025, CoinGecko Trading Volume Report 2025, and platform reports (binance.com, coinbase.com). Fees vary by volume, VIP tiers (e.g., Binance VIP 1: 25M USDT volume), region. Verify with official sources.

Security Features:

- Binance: Multi-signature wallets*, 2FA, cold storage, SOC 2 compliance, Proof of Reserves, $1B SAFU fund. Faces regulatory scrutiny (SEC, ongoing compliance).

- Coinbase: Public company (COIN), US-regulated, 2FA, 98% cold storage, FDIC-insured USD balances up to $250,000, external audits.

Multi-sig wallets: Require multiple keys to authorize transactions, enhancing security. SAFU: Binance’s Secure Asset Fund for Users, covering losses from hacks. 2FA: Two-factor authentication, adding an extra login layer.

Transaction Speed:

- Coinbase: ACH deposits 1–3 days, crypto deposits ~10 minutes.

- Binance: Crypto deposits ~5 minutes, fiat deposits 1–2 days (region-specific).

Features & User Experience:

- Binance: Advanced platform with copy trading, crypto trading bots, 125x leverage (region-limited), 400+ coins, VIP fee discounts, and Launchpool for new token access. Bonuses: Up to $600 rewards after KYC, $100 deposit, 1,000 USDT trading volume.

- Coinbase: Beginner-friendly with simple UI, USD withdrawals, US regulatory compliance, and educational content. Bonuses: $10–$50 signup bonus, KYC, $100 deposit (illustrative, verify on coinbase.com).

Trading Strategies:

- Spot Trading: Coinbase’s simple UI suits small trades ($100 BTC/USDT, $0.40 fee at 0.4% maker), while Binance’s 0.06% spot fee with BNB saves $0.34/trade.

- Copy Trading: Binance’s copy trading (10% profit share) targets volatile pairs like SOL/USDT, unavailable on Coinbase.

- Passive Investing: Coinbase’s staking (4–6% APY for ETH) is simpler; Binance’s Simple Earn (5–10% APY for USDT) offers higher returns.

User Feedback: Trustpilot rates Binance 4.2/5 and Coinbase 4.0/5 for user experience (2025 data, illustrative, verify on Trustpilot).

Start Exploring Binance with a $600 Bonus or Join Coinbase with a $10 Bonus

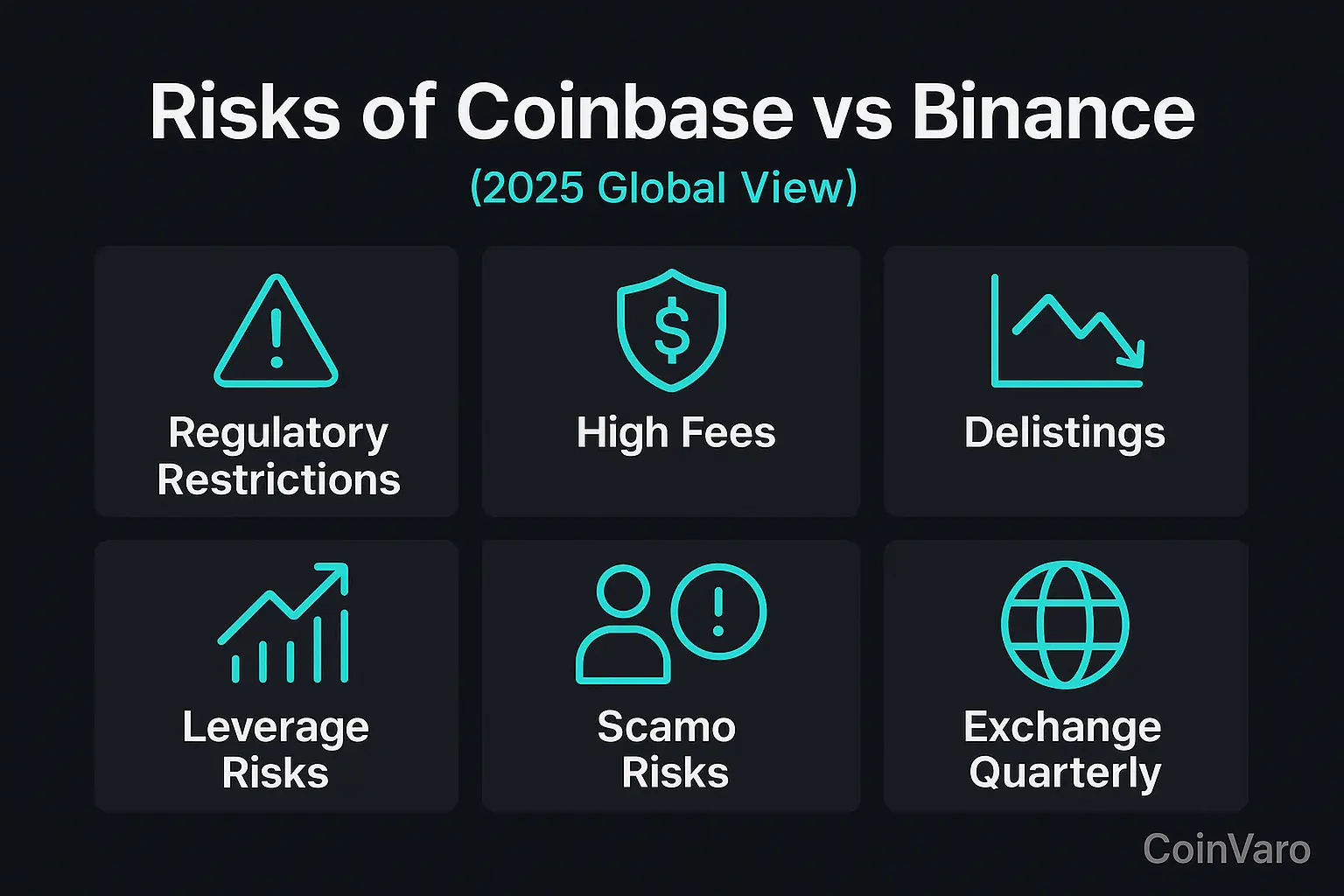

Risks of Coinbase vs Binance: What Global Traders Must Know

| Risk | What It Means | How to Mitigate |

|---|---|---|

| Regulatory Restrictions | Binance restricted in >15 US states, Belgium; Coinbase globally available | Verify compliance |

| High Fees (Coinbase) | 0.04%–4% spreads for small/instant buys | Use Coinbase Advanced Trade for lower fees |

| Coin Delistings | Binance may delist coins, disrupting bots | Monitor platform updates |

| Leverage Risks (Binance) | 125x leverage risks high losses | Set stop-loss, trade conservatively |

| Scams & P2P Risks | Scam USDT sellers reported on Reddit | Use official escrow, verify P2P traders |

General Risks:

- Crypto not FDIC-insured (except Coinbase USD balances up to $250,000).

- Enable 2FA, avoid sharing passwords.

- Use hardware wallets for large holdings.

Infographic: Key risks of Coinbase and Binance for global traders.

Alt: Infographic of Coinbase vs Binance risks 2025.

Caption: Understand risks before trading on Coinbase or Binance! Start safely.

Start Trading Safely with Binance

How to Choose Between Coinbase and Binance: 5-Step Global Checklist

- Check Availability: Binance restricted in >15 US states, Belgium; Coinbase available globally.

- Set Priorities: Simplicity, trust (Coinbase) vs. low fees, tools.

- Review Fees: Calculate trade size impact using.

- Test Security: Open account, enable 2FA, test $10–$50 deposit.

- Plan Long-Term: Need copy trading, bots, 400+ coins? Choose Binance. Prefer simplicity? Choose Coinbase.

Which Should You Choose?

- Beginners: Coinbase—easy UI, US compliance.

- Active traders: Binance—low fees, advanced tools (if available).

Compare Coinbase, Binance for Your Trading Goals

Case Studies

- Clara, Germany: Traded BTC/USDT on Coinbase for 3 months, saved $5 on $500 trade (0.4% maker fee). Illustrative; results vary.

- Linh, Singapore: Used Binance copy trading on SOL/USDT for 2 months, earned 1.5% monthly ROI (~$150) on $10,000 with stop-loss. Illustrative; results vary.

- Elena, Brazil: Traded ETH/USDT on Coinbase for 4 months, saved $3 on $300 spot trade (0.4% maker fee). Illustrative; results vary.

FAQ

- What is better, Binance or Coinbase?

Coinbase offers simplicity and US regulation; Binance has lower fees, more coins, and advanced tools. - What are the fees for Coinbase vs Binance?

Coinbase: 0.4% maker/0.6% taker, 0.04%–4% spreads; Binance: 0.1% spot (0.06% w/BNB), 0.02%/0.05% futures. - Which is safer, Coinbase or Binance?

Coinbase’s US regulation, FDIC-insured USD balances offer trust; Binance’s $1B SAFU fund, SOC 2 are robust. - Coinbase vs Binance for day trading 2025?

Binance’s low fees (0.06% spot), futures suit day traders; Coinbase’s high fees (0.4%) less ideal. - Which is better for beginners?

Coinbase’s simple UI suits beginners; Binance is better for advanced traders. - Why choose Binance for trading?

Binance offers low fees (0.06% spot w/BNB), copy trading, and 400+ coins, ideal for active traders.

Fees, features, and availability may change. Verify on official exchange websites.

Internal Resources

Explore more guides to boost your crypto profits!

- Best Crypto Exchange for Day Trading

- Binance Copy Trading

- Best Crypto Trading Bot

- Best Crypto for Staking

Compare Coinbase and Binance to find the best exchange for your needs. Which suits you—Coinbase’s simplicity or Binance’s advanced tools? Share on X with #CryptoTrading!