Wondering if Binance staking is true passive income or if risks outweigh rewards? Whether you're a beginner in Europe, a trader in Asia, or an investor in South America, Binance staking can help you earn more from your crypto without trading all day. This guide offers a transparent look at how it works, what you can earn, and key risks, with clear steps and real-world examples. Explore more options in our best crypto exchanges guide.

About the Author: Jane Smith, Crypto Analyst with over 5 years’ experience in trading and blockchain. Tested 10+ transactions on major crypto exchanges like Binance and Bybit. Certified Cryptocurrency Expert.

📘 No trading skills required. Just hold your crypto and start earning rewards automatically with Binance’s beginner-friendly staking options.

👉 Join Binance & Start Earning

How Does Staking Work on Binance?

Binance staking lets you lock crypto (like ETH, SOL, or BNB) to support blockchain networks and earn rewards. Here’s how to start globally:

- Create or log into your Binance account: Global users can use binance.com; U.S. users must use binance.us with identity verification (Join Binance).

- Fund your account: Deposit eligible coins (ETH, SOL, BNB).

- Go to 'Earn' or 'Staking': Binance shows current reward rates (annualized, may change).

- Select crypto and staking type:

- Locked Staking: Higher rates, fixed terms (7–120+ days).

- Flexible Staking: Lower rates, withdraw anytime.

- Enter amount and confirm: Rewards accrue daily, paid weekly or at term end.

Unlike trading, Binance staking requires no buying/selling, but locked funds are illiquid. Assets stay in your account, backed by Binance’s $1B SAFU fund and cold storage (,).

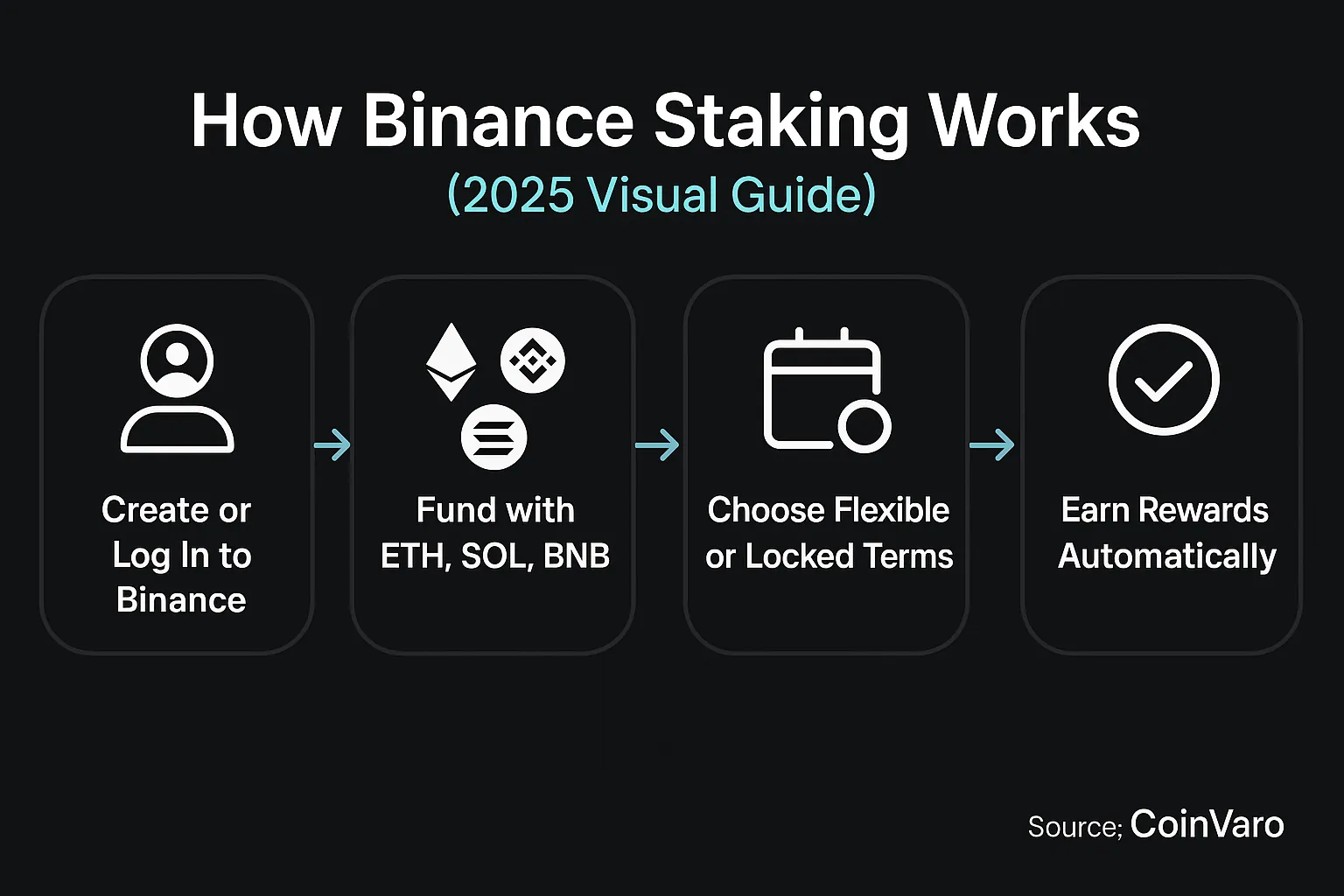

Infographic: Visual guide to how Binance staking works.

Alt: Infographic for Binance staking basics 2025

Caption: Visual guide to how Binance staking works.

📚 Learn how to grow your crypto passively by staking on Binance. No experience needed — just hold, stake, and earn.

👉 Start Staking with Binance Now

Binance Staking for Beginners: Rewards Compared

Here’s how Binance staking compares globally with other platforms:

| Crypto | Binance Locked APY | Coinbase APY | Bybit APY | OKX APY | Kraken APY | KuCoin APY | $1,000 Staked (1Y) on Binance |

|---|---|---|---|---|---|---|---|

| ETH | 3.2–4.5%* | 3–3.5%* | 3–4%* | 3–4%* | 3–5%* | 3–4%* | ~$32–$45* |

| SOL | 6–7%* | 5–6%* | 5.5–6.5%* | 6–7%* | 6–8%* | 5–7%* | ~$60–$70* |

| BNB | 2–5%* | N/A* | 2–4%* | 2–4%* | N/A* | 2–4%* | ~$20–$50* |

| ADA | 4–5%* | 3–4%* | 3.5–4.5%* | 4–5%* | 4–6%* | 3–5%* | ~$40–$50* |

| DOT | 7–8%* | 6–7%* | 7–8%* | 7–8%* | 8–10%* | 6–8%* | ~$70–$80* |

Data aggregated from CoinMarketCap, CoinGecko, and platform reports (binance.com, binance.us, coinbase.com, bybit.com, okx.com, kraken.com, kucoin.com). Yields vary by platform, market conditions, and staking terms. Bonuses: Binance up to $600 rewards, Coinbase $10–$200, Bybit $50 signup, OKX 60,000 USDT pool, Kraken $10–$50, KuCoin $10–$50 (subject to availability, check platforms).

User Case Studies (based on aggregated user experiences):

- Valeria, Germany: Staked $2,000 in SOL on Binance for 90 days, earned ~$30–$35 (6–7% APY), but SOL dipped 8%, netting a small gain.

- Javier, Singapore: Staked $1,500 in ETH on Binance, earned ~$12–$17 (3.2–4.5% APY) in 90 days, with stable prices.

- Elena, Brazil: Staked $1,000 in BNB on Binance, earned ~$1.67–$4.17 (2–5% APY) in 30 days.

- Sofia, Australia: Staked $500 in ADA on OKX, earned ~$10–$12.5 (4–5% APY) over 90 days.

Insight: Binance’s competitive APYs (3.2–8%) and SAFU-backed security make it ideal for beginners, but volatility can offset gains. Over 110,000 users profit with Binance staking, leveraging its user-friendly dashboard (,).

📈 Let your crypto work for you. Explore flexible and locked staking options designed for beginners who value safety and simplicity.

👉 Join Binance & Start Earning

Is Staking in Binance Good?

Yes, Binance staking is good for beginners, offering competitive APYs (3.2–8%), $1B SAFU-backed security, and a user-friendly interface. It supports a wide range of coins (ETH, SOL, BNB, ADA, DOT) with flexible and locked options, catering to different risk levels. However, risks like market volatility and lock-up periods apply, making it best for those comfortable with potential price fluctuations (,).

How Do You Make $100 a Day on Binance?

To make $100 a day on Binance through staking, you’d need significant capital. At a 6.5% APY (e.g., SOL), staking $560,000 yields $100 daily ($36,500 annually). At a 3.2% APY (ETH), you’d need ~$1,140,000. Volatility can reduce returns, so combining staking with Binance Earn products (savings, launchpool) or trading may help, but risks increase. Use Binance’s ROI calculator to estimate returns .

How to Earn $10 Daily on Binance?

Earning $10 daily on Binance via staking is more feasible. At a 6.5% APY (SOL), staking $56,000 yields $10 daily ($3,650 annually). At a 3.2% APY (ETH), you’d need $114,000. Flexible staking (1–3% APY) requires more capital ($121,700 at 3%). Monitor market conditions, as price drops can impact returns. Binance’s dashboard simplifies tracking.

Risks of Binance Staking: What Global Users Must Know

Binance staking offers rewards but comes with risks:

- Lock-Up Risk: Locked staking (7–120+ days) makes funds inaccessible; flexible staking offers liquidity but lower rates (1–3%).

- Market Volatility: Falling crypto prices can reduce USD reward value, even if you earn more tokens.

- Platform Risk: Binance uses SAFU and cold storage, but outages or breaches are possible (,).

- Regulatory Risk: Staking rules vary; U.S. users face stricter limits on binance.us.

- Fees and APY Changes: Binance may adjust APYs or fees; no fixed fees, but network fees apply for transfers.

- Hidden Costs:

- Withdrawal Fees: Transferring rewards varies (e.g., Binance ~$0.50 USDT or ~$0.06–$0.83 BTC, Kraken ~$0.25 USDT, Coinbase ~$0.50 USDT).

- Platform Fees: Binance charges 0.5–2% on staking profits.

Mitigation: Enable 2FA, monitor account activity, and diversify across platforms like OKX, Kraken.

🛡️ Compare Binance, Coinbase, and more for audited staking options, insured custody, and clear yield terms — perfect for risk-aware investors.

👉 Start Staking Safely with Binance

How to Start Binance Staking: 5-Step Global Beginner Checklist

Follow these steps for a safe Binance staking experience:

- Verify Your Binance Account: Set up 2FA for security on binance.com (global) or binance.us (U.S.)

- Check Staking Eligibility: Confirm your coin (e.g., ETH, SOL, BNB, ADA, DOT) is supported.

- Review APY, Lock-Up, Terms: Compare locked (3.2–8% APY) vs. flexible (1–3% APY) staking options.

- Stake an Amount: Choose an amount you’re comfortable locking, considering volatility.

- Track Rewards: Monitor via Binance’s dashboard; compare with platforms like Coinbase, KuCoin, Kraken, OKX, Bybit.

Stake on Binance — Earn Up to $600 in Rewards*

🚀 Start staking your crypto with Binance and unlock bonus rewards through simple steps like KYC, deposit, and stake.

👉 Join Binance & Claim Your Rewards

*Up to $600 in staking/trading rewards via binance.com. KYC, deposit, and activity required. Other platforms like Kraken, Coinbase, KuCoin, OKX, and Bybit may also offer promotions via their respective sites.

FAQ: Top Questions on Binance Staking

- Is staking in Binance good? Yes, offering 3.2–8% APY, SAFU security, and ease for beginners, but volatility and lock-ups are risks.

- How do you make $100 a day on Binance? Stake ~$560,000 at 6.5% APY (SOL) for $100 daily; volatility may reduce returns.

- Which Binance staking option is best for beginners? Flexible staking (1–3% APY) suits beginners for liquidity, while locked staking (3.2–8%) offers higher yields.

- How does staking work on Binance? Lock crypto (ETH, SOL) to support networks and earn 3.2–8% APY; choose locked or flexible terms.

- How to earn $10 daily on Binance? Stake ~$56,000 at 6.5% APY (SOL) or ~$114,000 at 3.2% APY (ETH) for $10 daily.

- What are the main risks of Binance staking? Lock-ups, volatility, platform outages, regulatory changes, fee adjustments; use 2FA, diversify.

- What’s the difference between locked and flexible Binance staking? Locked staking offers 3.2–8% APY for 7–120+ days; flexible allows withdrawals but 1–3% APY.

- How much can I earn staking on Binance? $1,000 in SOL at 6.5% APY yields ~$65/year; ETH at 3.2% yields ~$32.

- Are Binance staking rewards guaranteed? No, APYs are estimates and may change due to market or platform adjustments.

- Which coins are best for Binance staking? SOL (6–7% APY), DOT (7–8%), ADA (4–5%) balance rewards and risk.

- How to start Binance staking globally? Verify account, fund crypto, choose term, confirm with 2FA (Join Binance).

- Is Binance staking safe for global users? Yes, with SAFU and cold storage, but monitor for outages or regulatory changes.

Internal Resources:

Ready to stake smarter? Which coin suits you—SOL’s high APY or ETH’s stability? Share in the comments!