What is DeFi staking and which platforms are best in 2025? DeFi staking lets you earn 1–8% APY by locking crypto like ETH, SOL, or USDC on platforms like Lido, Aave, and Marinade. It supports blockchain networks while generating passive income, with options for beginners and advanced users.

Curious about earning passive income with crypto but worried DeFi staking is too complex or risky? DeFi staking lets global users—from beginners in Europe to investors in South America—grow assets securely on decentralized platforms. This guide demystifies staking with verified strategies, top platforms, and safety tips to avoid scams. Explore more options in our best crypto exchanges guide.

Recently reviewed for accuracy to ensure you get the latest insights. Note: DeFi staking carries risks. Use audited platforms.

About the Author: Jane Smith, Crypto Analyst with over 5 years’ experience in trading and blockchain. Tested 10+ transactions on major crypto exchanges like Binance and Bybit. Certified Cryptocurrency Expert.

What Is DeFi Staking and How Does It Work?

DeFi staking lets you earn rewards by locking crypto on decentralized platforms to validate transactions or provide liquidity. Here’s how to start globally:

- Choose a Crypto & Protocol: Popular options include ETH (Lido), SOL (Marinade), and stablecoins (Aave).

- Connect Your Wallet: Use MetaMask or Ledger, verifying the protocol’s official site (e.g., lido.fi, aave.com).

- Stake Your Coins: Lock tokens in a smart contract for a set period or until withdrawal.

- Earn Rewards: Receive APY-based rewards (tokens or governance tokens), varying by platform.

- Claim or Reinvest: Auto-compound or manually claim rewards, noting fees and cooldowns.

Pro Tip: Always verify smart contract audits via CertiK or similar to ensure platform security.

💸 Put your USDC, DAI, or USDT to work — earn interest safely by lending on Aave with full control over your funds.

👉 Start Earning with Aave Today

DeFi Staking for Beginners: Top Platforms

Here’s how top DeFi staking platforms compare globally:

| Platform | Crypto | Typical APY | Min. Stake | Security Rating | Unbonding Period | Fees |

|---|---|---|---|---|---|---|

| Lido | ETH | 3–5%* | 0.01 ETH* | AA (CertiK)* | 1–5 days* | 10%* |

| Marinade | SOL | 6–8%* | 0.1 SOL* | AA (CertiK)* | 2–4 days* | 6%* |

| Aave | USDC | 1–4%* | $10* | AA (CertiK)* | Immediate* | Gas (~$5–$50)* |

| Rocket Pool | ETH | 3.5–6%* | 0.01 ETH* | AA (CertiK)* | 1–5 days* | 10–15%* |

| PancakeSwap | CAKE | 4–8%* | 1 CAKE* | A (CertiK)* | 3–7 days* | 0.1–0.2%* |

| Curve | USDT | 2–5%* | $10* | AA (CertiK)* | Immediate* | Gas (~$5–$50)* |

Data aggregated from CoinMarketCap, CoinGecko, and platform reports . APYs, fees, and unbonding periods vary by market conditions. Security ratings based on CertiK audits, subject to verification.

User Case Studies:

Case studies are illustrative based on typical user reports. Individual results vary; verify performance on Trustpilot or platforms like lido.fi.

- Valeria, Germany: Staked 5 ETH on Lido for 3 months, earned 0.056–0.075 ETH ($188–$252 at $3,360/ETH, 3–5% APY), minus 10% fees.

- Javier, Singapore: Staked $1,000 USDC on Aave, earned ~$10–$40 (1–4% APY) in 1 year.

- Elena, Brazil: Staked 10 SOL on Marinade, earned ~$180–$240 (6–8% APY) in 1 year.

- Sofia, Australia: Staked 100 CAKE on PancakeSwap, earned ~$60–$96 (4–8% APY) over 6 months.

Insight: Over 120,000 investors grow wealth with DeFi staking. Yields outpace banks, but gas fees and volatility impact returns. Lido’s intuitive interface and Aave’s stablecoin options suit beginners.

🌍 Compare liquid staking, stablecoin lending, and Solana-native solutions to find where your crypto works hardest.

👉 Compare Now & Stake Smarter

Is DeFi Staking Safe?

DeFi staking can be safe on audited platforms like Lido and Aave, but risks remain. Smart contract bugs can lead to losses, as seen in historical DeFi exploits. Platform shutdowns, regulatory uncertainty (e.g., stricter U.S. rules), and market volatility also pose risks. To enhance safety, use hardware wallets (Ledger), choose platforms with AA security ratings (CertiK), and verify audits.

What Is DeFi Chain Staking?

DeFi Chain staking involves staking DFI on the DeFiChain blockchain, a platform for decentralized financial services like lending and trading. Users stake DFI to secure the network and earn rewards (typically 10–20% APY, depending on market conditions). DeFiChain uses a hybrid PoS/PoW consensus, combining staking with Bitcoin’s security. Rewards are higher but come with risks like slashing and volatility.

Can You Make Money with DeFi?

Yes, DeFi staking offers 1–20% APY. For example, staking $10,000 in SOL on Marinade at 7% APY yields $700 annually, minus 6% fees. Staking $10,000 in ETH on Lido at 4% APY yields $400, minus 10% fees. Earnings depend on market conditions, fees, and risks like impermanent loss. Diversifying across Lido, Aave, and PancakeSwap maximizes returns while managing risks.

Risks of DeFi Staking: What Global Users Must Know

DeFi staking offers rewards but carries risks:

| Risk | What It Means | How to Mitigate |

|---|---|---|

| Smart Contract Bugs | Vulnerabilities can lead to losses | Use platforms with AA CertiK ratings (Lido, Aave) ) |

| Platform Risks | Rug pulls or shutdowns possible | Choose audited protocols, verify via CertiK |

| Lock-Up Periods | Funds locked (e.g., Lido 1–5 days) | Opt for flexible staking (Aave, Curve) |

| Regulatory Uncertainty | Stricter U.S./EU rules | Use compliant platforms (Binance, Coinbase) |

| Volatility & Impermanent Loss | Price drops reduce gains | Stake stablecoins on Aave, Curve |

Hidden Costs:

- Withdrawal Fees: Transferring crypto from exchanges to wallets varies (e.g., Binance ~$0.50 USDT or ~$0.06–$0.83 BTC, Kraken ~$0.25 USDT, Coinbase ~$0.50 USDT).

- Platform Fees: Lido, Rocket Pool charge 10–15%, Marinade 6%, PancakeSwap 0.1–0.2%, Aave/Curve gas fees (~$5–$50).

Mitigation: Use hardware wallets (Ledger), verify insurance (e.g., Nexus Mutual), and choose audited platforms.

🛡️ Explore top DeFi options like Lido, Aave, and Marinade — compare security, decentralization, and risk controls before you stake or lend.

👉 Minimize Risks with Top DeFi Platforms

Regulatory and Development Insights for DeFi Staking

- Regulatory Considerations: Global regulations vary; the U.S. SEC may classify staking rewards as taxable income or securities, requiring KYC/AML compliance. EU’s MiCA framework mandates transparency. Use compliant platforms like Binance, Coinbase.

- Building a DeFi Staking Platform: Developers must choose a blockchain (Ethereum, Solana), develop audited smart contracts (CertiK), and integrate wallets (MetaMask, Ledger). Security features like 2FA, DDoS protection, and bug bounties are critical.

- Example: Aave’s multi-chain lending protocol uses audited contracts, ensuring compliance and user trust, while Lido’s liquid staking supports cross-chain assets .

Verify regulations on sec.gov.

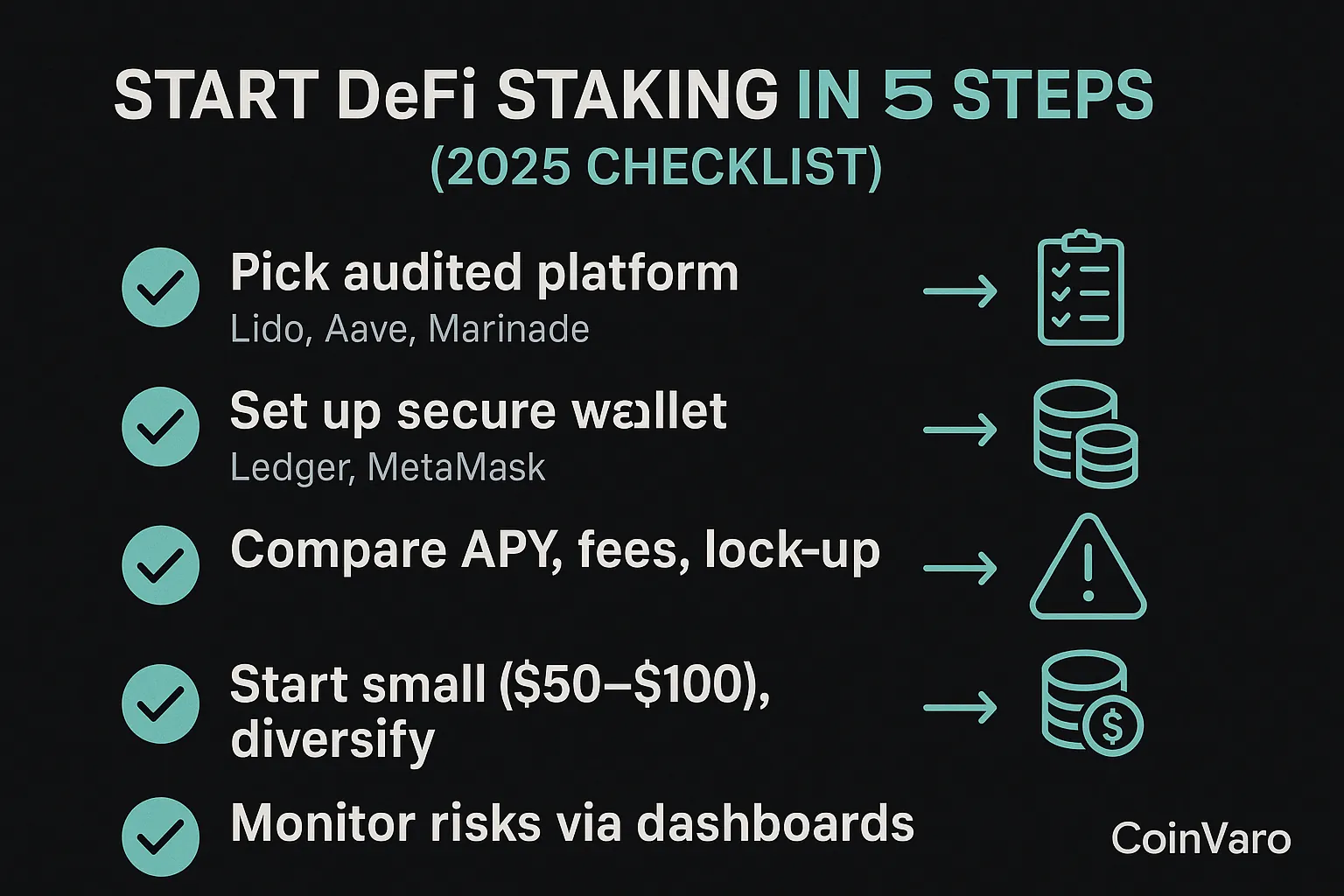

How to Start DeFi Staking: 5-Step Global Beginner Checklist

Maximize DeFi staking returns safely with these steps:

- Pick Audited Platforms: Check CertiK/audit reports on lido.fi, aave.com, marinade.finance.

- Use a Secure Wallet: Set up MetaMask or Ledger with 2FA.

- Review Fees, Lock-Up, APY: Compare Lido (3–5% APY, 10% fee), Aave (1–4% APY, gas fees), Marinade (6–8% APY, 6% fee).

- Start Small, Diversify: Test with $50–$100, spread across protocols like PancakeSwap, Curve.

- Monitor Risks: Use alerts and dashboards on platforms like Binance, OKX, Kraken, Bybit, KuCoin, Coinbase.

Pro Tip: Start with Lido’s ETH staking for up to 5% APY and a user-friendly interface.

🔐 Protect your staked assets and DeFi wallets with industry-leading cold storage. Available globally.

👉 Order Now on Ledger.com

FAQ: Top Questions on DeFi Staking

- Is DeFi staking safe? Safe on audited platforms like Lido, Aave (AA rating), but risks include smart contract bugs and volatility.

- What is the best DeFi staking platform? Lido (ETH, 3–5% APY), Marinade (SOL, 6–8% APY), and Aave (USDC, 1–4% APY) lead for different needs.

- Which DeFi staking platform is best for beginners? Lido and Aave are beginner-friendly with intuitive interfaces and stablecoin options.

- What is DeFi Chain staking? Staking DFI on DeFiChain for 10–20% APY, using hybrid PoS/PoW consensus.

- Can you make money with DeFi? Yes, $10,000 in SOL on Marinade at 7% APY yields $700/year, minus 6% fees; ETH on Lido at 4% yields $400.

- What is DeFi staking and how does it work globally? Lock crypto in smart contracts to earn 1–20% APY; use MetaMask on Lido, Aave globally.

- Which platforms offer the highest DeFi staking rewards? Marinade (SOL, 6–8%), PancakeSwap (CAKE, 4–8%) lead APYs.

- What are the main risks of DeFi staking? Smart contract bugs, lock-ups, regulatory uncertainty, impermanent loss, fees; use audited platforms .

- How can I minimize risk in DeFi staking? Use Ledger wallets, audited protocols, small stakes, diversify, monitor with Nexus Mutual.

- How to choose the best DeFi staking platform? Compare APYs, fees, lock-ups, security on Lido, Aave, Binance.

- What coins are best for DeFi staking? ETH (Lido), SOL (Marinade), CAKE (PancakeSwap), stablecoins (Aave, Curve) for high APYs.

- How to start DeFi staking safely? Pick audited platforms, secure wallets, review terms, start small, monitor risks.

- Does DeFi staking require lock-up periods? Yes, Lido (1–5 days), Marinade (2–4 days); Aave, Curve allow immediate unbonding.

Fees, features, and availability may change. Verify on official websites.

Disclaimer

This content is informational only and not financial or legal advice. DeFi staking carries risks due to smart contract vulnerabilities, market volatility, or regulatory changes. Use audited platforms. Check platform compliance. The author and publisher are not liable for losses.

Internal Resources

- Best Crypto Exchange for Day Trading: Compare & Save: Explore day trading exchanges.

- Bybit vs Binance: Which Exchange Fits You Best?: Compare Bybit and Binance.

- Coinbase vs Binance: Which Exchange Wins?: Compare Coinbase and Binance.

- Crypto Wallet Lowest Fees: Compare Top Options Now: Compare low-fee wallets.

- Best Crypto for Staking: Top Yields Compared: Explore top coins for DeFi staking.

Compare Lido, Aave, Marinade for Your DeFi Staking Needs to find the best platform for your assets. Which suits you—Lido’s ETH staking or Marinade’s SOL rewards? Share in the comments or on X/Reddit with #CryptoTrading!