What is staking crypto meaning in 2025? Staking crypto lets you earn 3–14% APY by locking coins like Ethereum or Solana to validate blockchain transactions. Platforms like Binance, Coinbase, and Lido make it easy for beginners to start safely, supporting secure networks globally.

Wondering what staking crypto meaning is and if it can earn passive income? Staking crypto offers a safe entry for global beginners—from Europe to South America—who want more than HODLing. This guide explains staking crypto meaning, how it works, and how to start safely with verified platforms. Explore more options in our best crypto exchanges guide.

Recently reviewed for accuracy to ensure you get the latest insights. Note: Staking carries risks. Use audited platforms.

About the Author: Jane Smith, Crypto Analyst with over 5 years’ experience in trading and blockchain. Tested 10+ transactions on major crypto exchanges like Binance and Bybit. Certified Cryptocurrency Expert.

Start Earning Passive Income by Staking Crypto on Binance

📈 Discover how to grow your holdings with staking — simple, secure, and available worldwide for new investors.

👉 Join Binance & Start Staking Today

How Does Crypto Staking Work?

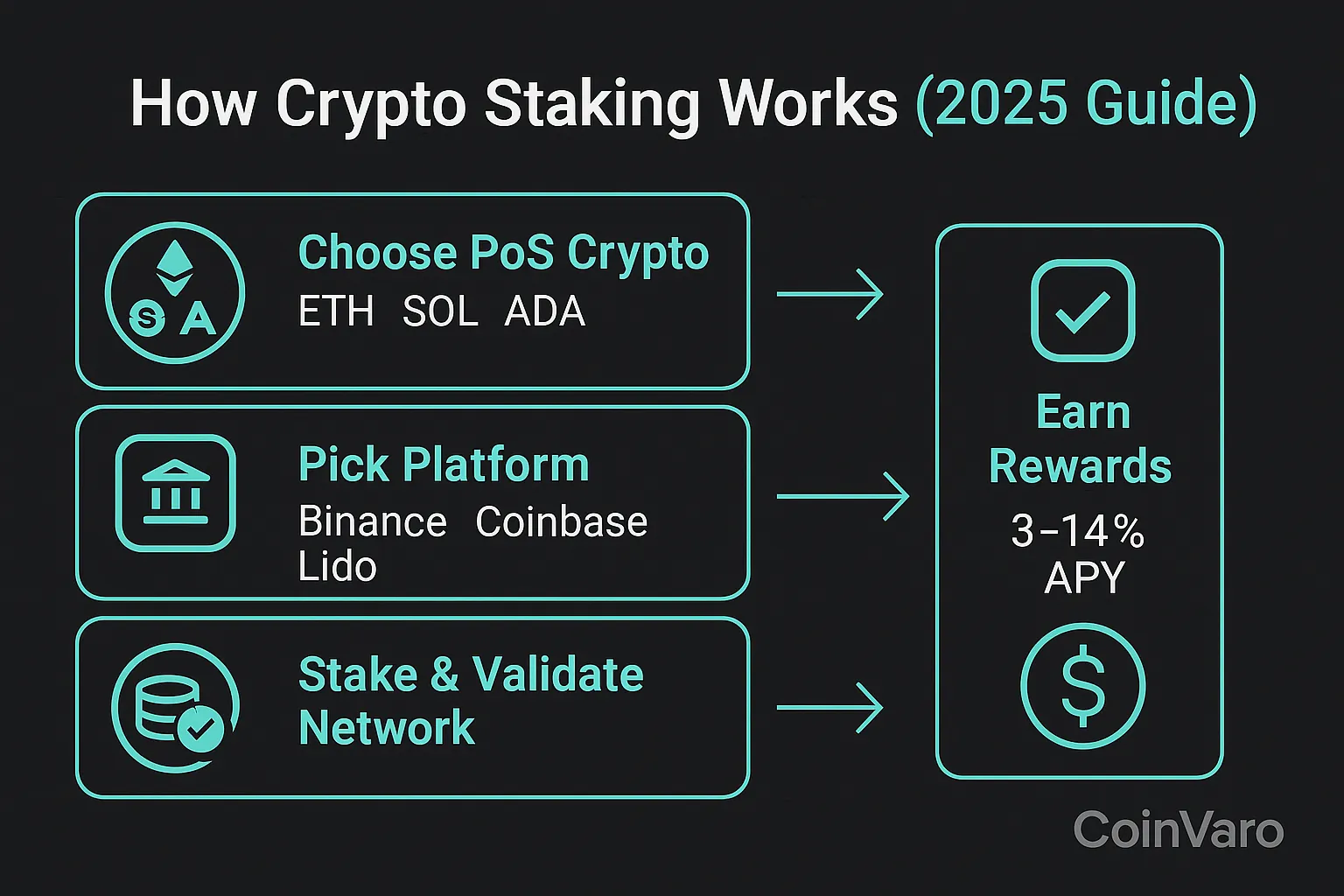

Crypto staking involves locking your cryptocurrency in a blockchain to help secure it and validate transactions, earning rewards like interest. Instead of letting coins like Ethereum or Solana sit idle, you stake them to grow your holdings. Here’s how it works globally:

- Choose a Crypto: Only Proof-of-Stake (PoS) coins like Ethereum, Solana, Cardano support staking.

- Select a Platform: Use regulated exchanges like Binance, Coinbase, or DeFi platforms like Lido.

- Lock Tokens: Commit coins for a period (1 day to months) via wallet or exchange.

- Validate Network: Your coins act as network validators, supporting PoS blockchain security and transactions, greener than Bitcoin mining.

- Earn Rewards: Get 3–14% APY, paid in crypto, depending on coin and lock-up.

Technical Details of Staking:

- Validator Role: Staked coins support validators in PoS blockchains (e.g., Ethereum, Solana), who confirm transactions and add blocks. Validators require high uptime; errors risk slashing penalties.

- Network Rewards: Rewards come from transaction fees and block rewards, distributed proportionally to staked amounts. For example, Ethereum validators earn ~3–5% APY, Solana ~6–8%.

- Example: Staking 10 ETH on Coinbase delegates to their validator pool, earning ~0.3–0.5 ETH/year, minus 15–25% fees. Binance’s SOL staking pools yield ~0.6–0.7 SOL/year for 10 SOL, minus 0.5–2% fees (binance.com).

Verify details on coinbase.com.

Pro Tip: Staking supports blockchain security while earning you rewards, making it a win-win for beginners.

📚 Learn how to earn rewards from holding crypto. No trading required — just stake and watch your assets grow.

Staking Crypto Meaning for Beginners: Top Platforms

Here’s how top staking crypto platforms compare globally:

| Platform | Crypto | Typical APY | Lock-Up Required | Actual ROI | Fees |

|---|---|---|---|---|---|

| Lido | ETH | 3–5%* | 1–5 days* | 2.7–4.5%* | 10%* |

| Binance | SOL | 6–7%* | 7–90 days* | 4.8–6.8%* | 0.5–2%* |

| Coinbase | ETH | 3–5%* | None* | 2.25–3.75%* | 15–25%* |

| OKX | ADA | 4–5%* | 15–60 days* | 3.5–4.5%* | 0–1%* |

| Kraken | DOT | 8–14%* | 28 days* | 6.8–11.9%* | 10–15%* |

| KuCoin | MATIC | 4–7%* | 7–30 days* | 3.5–6.5%* | 0–1%* |

Data aggregated from CoinMarketCap, CoinGecko, and platform reports . APYs, lock-ups, and fees vary by market conditions. Bonuses: Binance up to $600 rewards, Coinbase $10–$200, OKX 60,000 USDT pool, Kraken $10–$50, KuCoin $10–$50 (subject to availability, check platforms).

User Case Studies:

Case studies are illustrative based on typical user reports. Individual results vary; verify performance on Trustpilot or platforms like binance.com.

- Valeria, Germany: Staked $1,000 in SOL on Binance for 6 months, earned ~$30–$35 (6–7% APY), minus 0.5–2% fees.

- Javier, Singapore: Staked 10 SOL on Marinade, earned ~$60–$80 (6–8% APY) in 1 year.

- Elena, Brazil: Staked $500 in ETH on Coinbase, earned ~$7.5–$12.5 (3–5% APY) in 1 year.

- Sofia, Australia: Staked 100 ADA on OKX, earned ~$10–$12.5 (4–5% APY) over 6 months.

Insight: Over 130,000 beginners earn rewards with crypto staking. Yields outpace banks, but volatility and fees impact returns. Binance and Coinbase offer user-friendly dashboards for tracking.

Explore Global Staking Yields — Compare Binance with Other Top Platforms

📊 See which platform offers the best crypto rewards. Compare yields, lock-in periods, and flexibility to make the right choice for you.

👉 Join Binance & Start Staking Smarter

What Is the Risk of Staking Crypto?

Understanding staking crypto meaning includes knowing its risks:

| Risk | What It Means | How to Mitigate |

|---|---|---|

| Market Risk | Token prices can drop, offsetting rewards | Diversify across ETH, SOL, ADA |

| Platform Risk | Hacks or failures possible | Use regulated platforms like Binance, Coinbase |

| Lock-Up/Penalty Risk | Locked coins (e.g., Kraken 28 days) face penalties | Review terms on Lido, Kraken |

| Slashing Risk | Validator errors lead to losses | Choose reputable platforms like Coinbase, Kraken |

| Compliance Risk | Strict U.S./EU rules | Use compliant platforms like OKX, KuCoin ) |

Hidden Costs:

- Withdrawal Fees: Transferring rewards varies (e.g., Binance ~$0.50 USDT or ~$0.06–$0.83 BTC, Coinbase ~$0.50 USDT, Kraken ~$0.25 USDT).

- Platform Fees: Lido 10%, Binance 0.5–2%, Coinbase 15–25%, OKX 0–1%, Kraken 10–15%, KuCoin 0–1%.

Mitigation Tips:

- Choose licensed platforms.

- Diversify stakes across coins like ETH, SOL, ADA.

- Review lock-up terms on platforms like Kraken, OKX.

- Monitor regulatory updates (e.g., MiCA in EU).

🛡️ Choose trusted platforms for secure staking, insured custody, and transparent rewards — ideal for careful crypto investors.

👉 Compare Platforms & Stake with Confidence

How to Start Staking Crypto: 5-Step Global Beginner Checklist

Start staking crypto safely with these steps:

- Research Platforms: Choose Binance, Coinbase, Lido, OKX, Kraken, or KuCoin for compliance.

- Select Crypto: Pick ETH, SOL, ADA, DOT, or MATIC for high APY (3–14%).

- Secure Wallet/Exchange: Use 2FA on platforms like Binance, Coinbase.

- Review Terms: Check lock-up, fees, penalties on platforms like Kraken, Lido.

- Track Rewards: Monitor via platform dashboards; adjust for regulations.

📈 Decide where to earn the best yields with the lowest risk. Compare staking rewards, flexibility, and trust.

👉 Join Binance & Start Staking Smarter

FAQ: Top Questions on Staking Crypto Meaning

- Is staking worth it in crypto? Yes, offering 3–14% APY, outpacing savings accounts, but risks like volatility apply.

- How does crypto staking work? Lock PoS coins (e.g., ETH, SOL) to validate transactions and earn 3–14% APY.

- Can you make $1000 a month with crypto? Stake ~$150,000 at 8% APY for $1,000 monthly; diversify on Binance, OKX.

- What is the risk of staking crypto? Volatility, platform hacks, lock-up penalties, slashing, regulatory issues; use Coinbase, Kraken.

- Which staking crypto platform is best for beginners? Binance, Coinbase, and Lido offer user-friendly staking for beginners, with APYs from 3–14%.

- What does staking crypto meaning entail? Locking crypto to validate PoS blockchain transactions, earning rewards; supports ETH, SOL.

- Which platforms are best for staking crypto? Binance, Coinbase, Lido, OKX, Kraken, KuCoin for 3–14% APY, low fees.

- How much can I earn from staking crypto? $1,000 in SOL at 6.5% APY yields ~$65/year; ETH at 3.5% yields ~$35.

- Are staked funds locked up? Yes, lock-ups vary (e.g., Kraken 28 days); check terms on Binance, Lido.

- What is slashing in staking crypto? Penalties for validator errors, risking funds; use reputable platforms like Coinbase, Kraken.

- Is staking crypto safe globally? Safe on regulated platforms like Binance, KuCoin, but monitor volatility, slashing; comply with laws (e.g., MiCA in EU).

- Which cryptos are best for staking? ETH, SOL, ADA, DOT, MATIC for 3–14% APY and strong ecosystems.

- How to start staking crypto safely? Research platforms, select cryptos, secure wallet, review terms, track rewards on OKX, KuCoin.

Fees, features, and availability may change. Verify on official websites.

Disclaimer

This content is informational only and not financial or legal advice. Staking carries risks due to market volatility, platform issues, or regulatory changes. Use audited platforms. Check platform compliance. The author and publisher are not liable for losses.

Internal Resources

- Best Crypto Exchange for Day Trading: Compare & Save: Explore day trading exchanges.

- Best Hardware Wallet for Crypto: Compare Top Picks: Secure your staking with hardware wallets.

- Binance Staking: Rewards, Risks & How to Begin: Understand Binance staking.

- Best Copy Trading Platforms: Compare top platforms.

- Best Crypto Trading Bot: Compare Top Tools Now: Explore bot trading.

Compare Binance, Coinbase, Lido for Your Staking Needs to find the best platform for your assets. Which suits you—Binance’s low fees or Coinbase’s ease? Share in the comments or on X/Reddit with #CryptoTrading!